Zero-Based Budgeting

The Zero based budgeting method encourages you to use every cent of your monthly income. This does not mean spending all income! Rather, that every penny is given a purpose. Each month all income must be allocated to savings and expenses. The idea is that by the end of the month, your income minus your savings and expenses is zero.

Why use Zero-based Budgeting?

For many people their personal finances are a question mark. They don’t know how much they spend each month and tap into their savings over and over without knowing it. Zero-based budgeting will break your cycle of living paycheck to paycheck and help you put some money aside every month.

Unlike other budgeting models, Zero-Based budgeting is flexible. It allows you to update your budget and fine tune it as the month goes along to get a better picture of how the money was spent.

With Zero based budgeting you will see and track all of your expenses. Some will notice that they spend much more money than they think on certain things. Knowing your expenses is the first step to reduce them and focus more on your savings.

To take the full advantage of Zero based budgeting consider pairing it up with envelope budgeting and the 50/30/20 rule.

How to follow a Zero-based Budget with the UpSave App

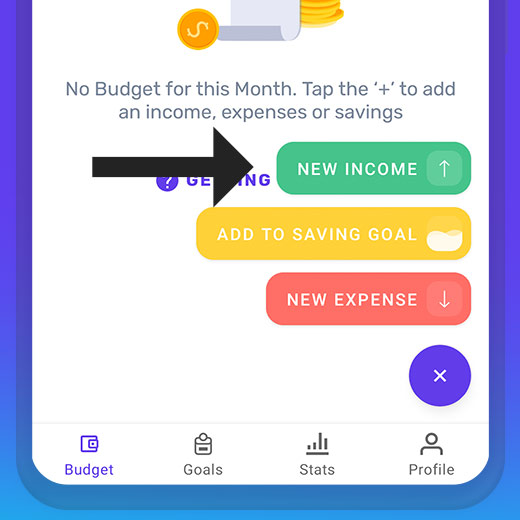

1. Input your monthly income.

Your income is what you earn from your primary job and other side hustles you might have. It might also be monthly checks you receive for child support, retirement pension and others. To do this, in the UpSave app tap the ‘+’ button and add ‘New Income’ for every income you receive. If your income is the same each month, you might find it helpful to set the income to auto repeat monthly.

2. Input your Monthly Expenses & Savings

Monthly Repeated Expenses

When a new Month starts take some time to input all the expenses that you need to pay that month. These could be your mortgage, loan repayments, rent, mobile plans, utilities, garbage collection fees, insurance fees, internet plans and others. These are expenses that most often happen monthly, so you can set them to auto repeat monthly. That way you only do it once. You can always delete an automatic monthly expense if you won’t be paying it on a particular month.

One-Off Expenses

You might have expenses that happen only once. This can be a birthday gift, maintenance costs, a new phone, health appointment costs and any other expenses that will happen only this month.

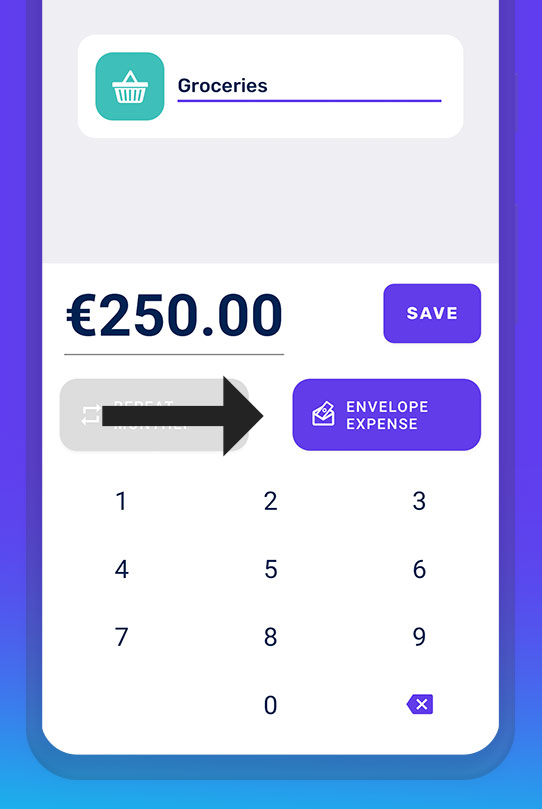

Expenses that can be grouped together

You might have noticed that we did not include Groceries, restaurants, cafes, transportation & clothes in the other categories. This is because such expenses that happen more than once a month would be better managed with expense envelopes.

To do this with UpSave, add a normal expense, but make sure to enable the ‘Envelope Expense’ button. This will make your expense look like in the screenshot below. Your expense will include a progress bar with how much you spent from your envelope. Tap on the envelope expense to add new transactions.

Savings

Each month your budget should not be only Expenses, but It should also include savings. In UpSave, savings are tracked using ‘Saving Goals’. So go ahead and create your custom saving goals from this section. Saving Goals can be a retirement plan, emergency funds, education funds or you might also want to save for a new car, laptop, phone, house and other goals.

A good way to know how much you should save is to use the 50/30/20 rule. That is 50% of your total income goes to needs, 30% towards wants and 20% towards savings and loan repayments.

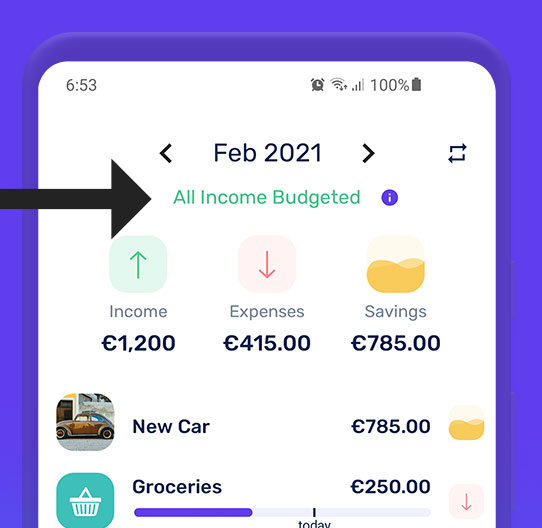

3. Make sure you have zero left to budget

You want to end up with Zero money to budget. Your income minus your savings and expenses must be zero. If you managed to balance your budget for the month, UpSave will display ‘All Income Budgeted’. If you have more money left to budget, you should save them up on a savings goal of your choosing. If you are in the negative, it means that you spent more than you earned. So you have to transfer back some of the money you saved.